TU-E4031 - Startup Finance D, Lecture, 29.2.2024-11.4.2024

This course space end date is set to 11.04.2024 Search Courses: TU-E4031

Översikt

-

-

Entrepreneurial Finance Market Personal Forecast (10%) Inlämningsuppgift

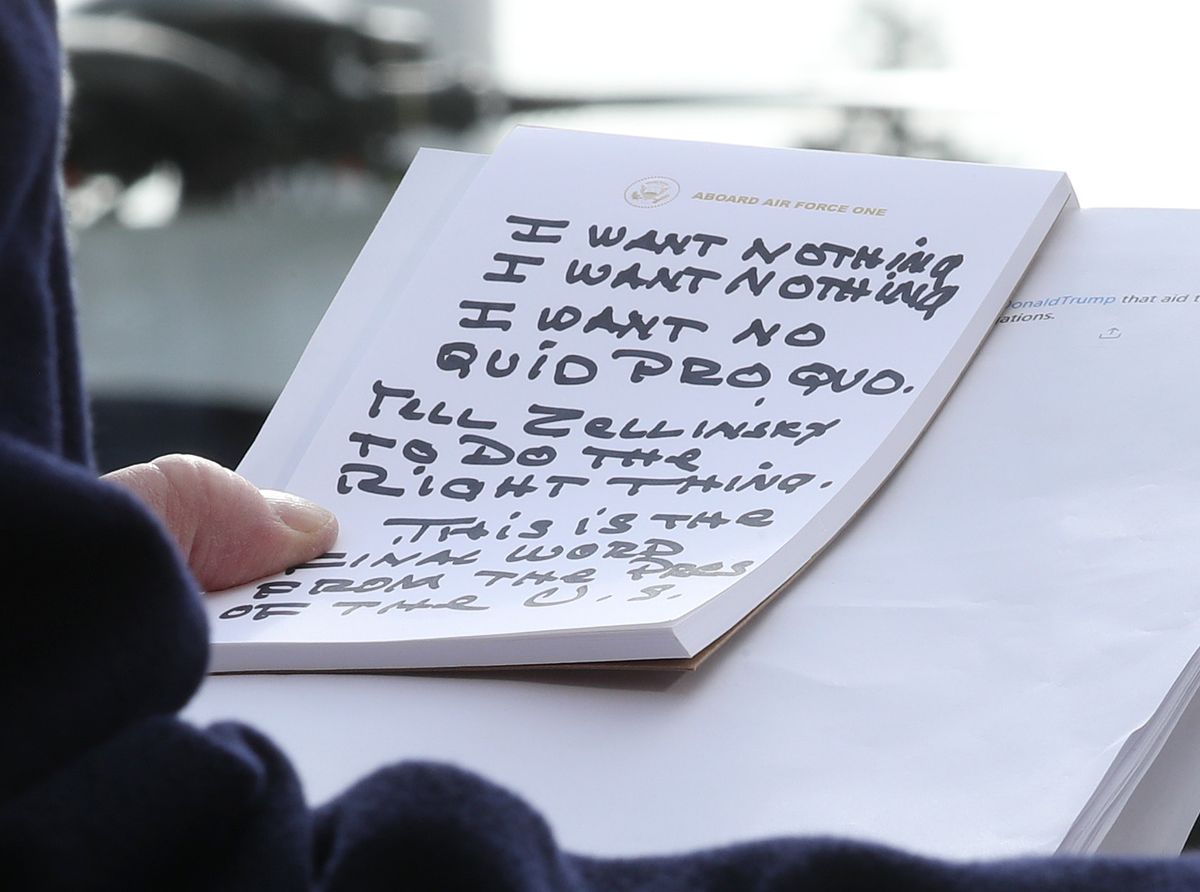

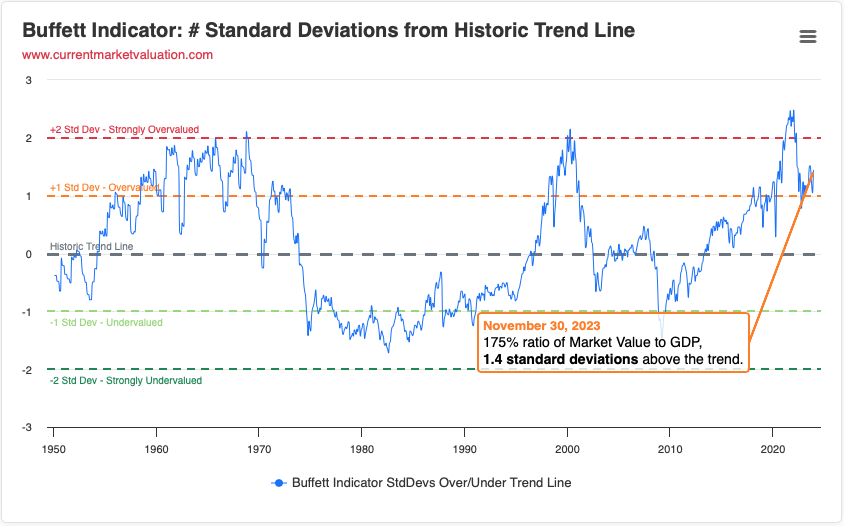

If Warren Buffett - the Oracle of Omaha - is right, we are on the back of an historically unprecedented time of stock market overvaluation that peaked in 2021. In 2021, more venture capital investment was made and more companies went public than any other year in history. 2022 and 2023 has witnessed a substantial fall and we are living in a time of inflation and interest rate pressure.

What is your personal outlook for entrepreneurial finance markets in 2024? If you were an entrepreneur seeking to raise funds, is this the right time to do it?

Justify your answers and integrate perspectives from the contemporary media / business press in your write up (max 3 page excluding exhibits)

-

Burn Stewart Take Home Exam (25%) Inlämningsuppgift

Hillman family portrait

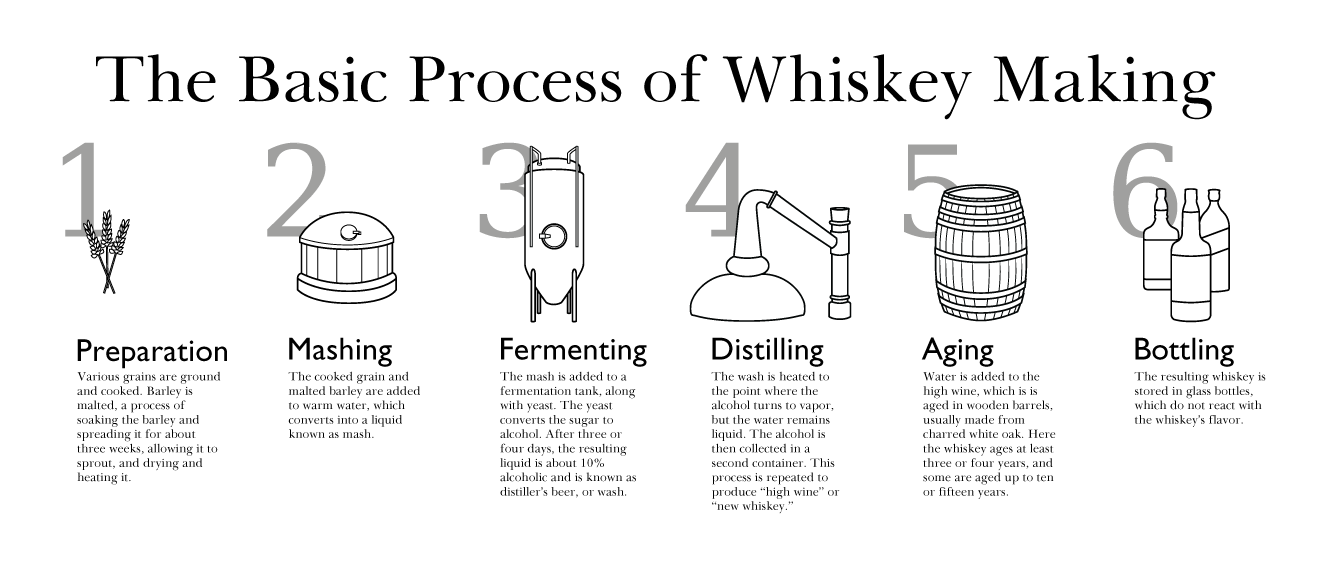

Fraser Thornton, an experienced Scotch Whiskey industry executive, has been approached by one of the shareholders of Burn Stewart to buy the company. Based on the last conversation with the company's accountant, the seller thinks the equity in the company is worth at least £4,5 million. How much are you prepared to pay for the company? How will the purchase be financed?

for guidance on how to approach the case, have a look at the attached document.

-

Peter's Insights on Burn Stewart (Video) Fil MP4

-

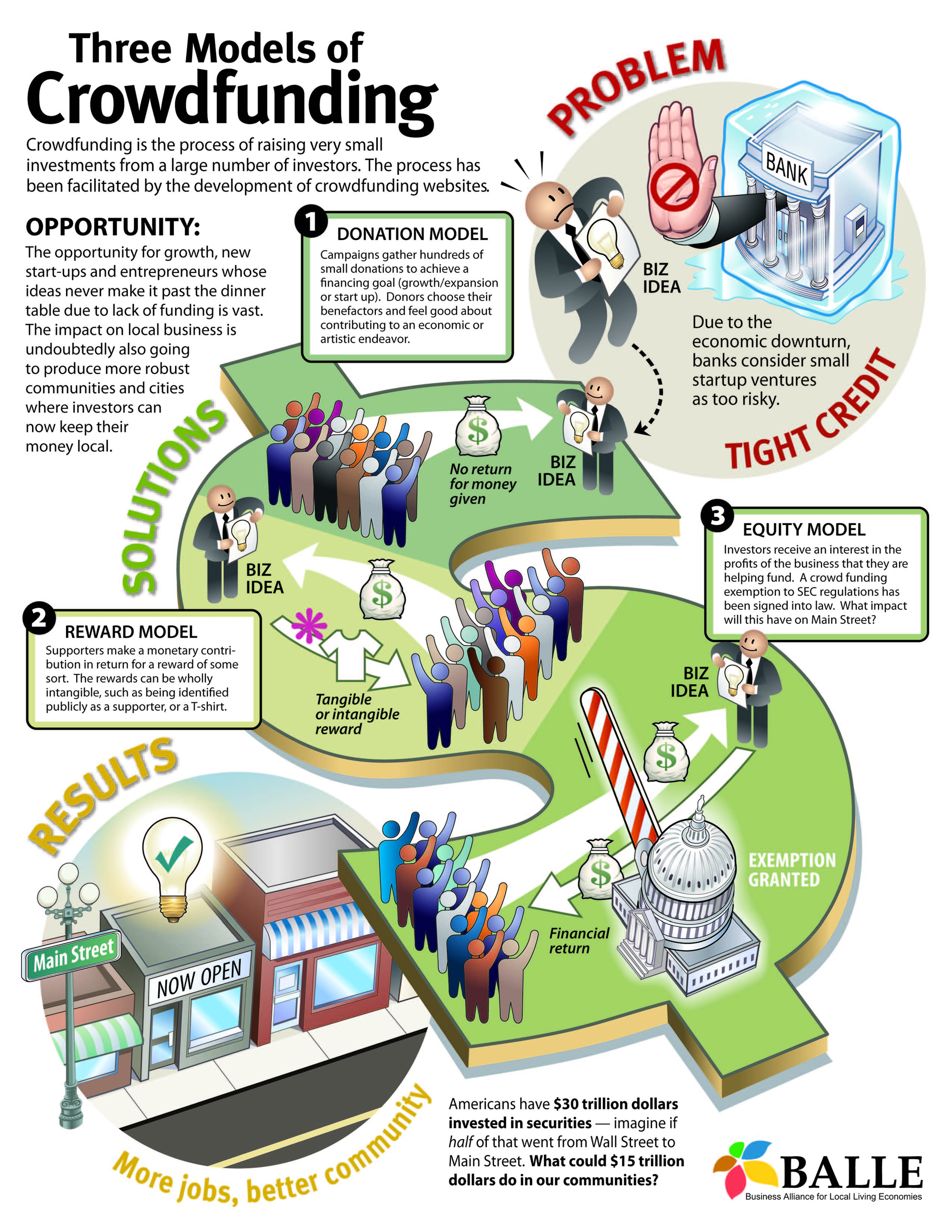

Reward Based Crowdfunding (5%) Inlämningsuppgift

An aspiring entrepreneur wants to launch a business to develop an innovative backpack they developed during their studies at Aalto and seeks your advice on whether to launch a REWARD based crowdfunding campaign on Kickstarter. Provide them with a balanced assessment of this financing option.

-

Emmy Clothing Company (5%) Inlämningsuppgift

The company is seeking to raise €500.000 on the Invesdor equity crowdfunding platform (https://www.invesdor.com/en-gb/).

Based on an examination of the offering prospectus (attached) and familiarising yourself with their platform (https://store.emmy.fi) and any other due diligence (a fancy legal term for checking the offering details out) you think necessary, would you invest in this business?

-

Business Angel Finance (5%) Inlämningsuppgift

Read through ALL three of the attached investment profiles (and yes they are dated!).

I want YOU to assume the role of a business angel with funds to invest in one of these proposals.

1) Which single investment opportunity would you invest in and why?

2) What questions/issues do you need clarification on before you invest?

3) What are the terms and conditions of your deal (including desired equity stake)?

-

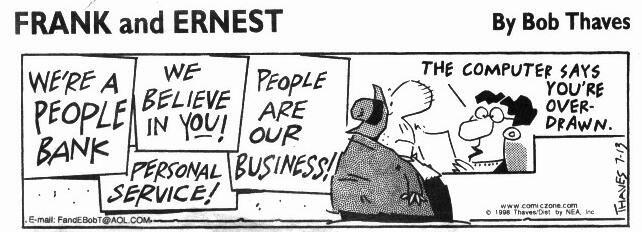

Advanced Business Computers (Case) (5%) Inlämningsuppgift

- Why did the bank refuse to increase the company's overdraft loan

- Assuming the company needs to raise £1 million in equity to support growth. What % equity stake will you as an investor require for investing the money? (provide an estimated valuation for ABC and detail your methodology in terms of calculation)

-

Book Retailing in 2024 (5%) Inlämningsuppgift

A peek inside Daunt's bookstore in London.

The bookstore business seems to be a "cat with 9 lives" whose long term prospects have been written off with the advent of etail (Amazon), digitalization, and COVID. In 2024 and beyond, does book retailing have a promising future? Justify your answer with insights from the contemporary business press. I have also added a couple of very contemporary articles about James Daunt (Barnes & Noble) and another article I stumbled upon.

-

Young Guns vs Old Farts (5%) Inlämningsuppgift

Read through this blog post from Artturi Tarjanne, General Partner of Nexit Ventures;

https://www.nexitventures.com/blog/young-guns-vs-old-farts/

1) It seems to be accepted wisdom in venture capital circles that "experience counts". Do you think this is true? (justify your answer)

2) He calls for more diversity in terms of experience (and age) in founding teams. How should the formation of such diverse teams be stimulated?

AND IN CASE YOU ARE REALLY INTERESTED IN THE NITTY GRITTY DETAILS - THE FULL PAPER IS ATTACHED :)

-

Leveraging Networks (5%) Inlämningsuppgift

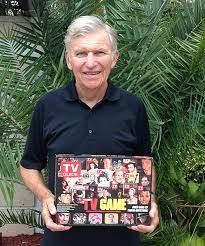

Robert Reiss, Harvard MBA and Founder of TV Guide Game. Tapping into your social network for capital, assistance and leads is a crucial transactional lubricant for any aspiring entrepreneur. How did and why was he so successful in convincing so many others to to exploit this opportunity?

-

Group Project (40%) Inlämningsuppgift

-