LEARNING OUTCOMES

By the end of the course, students should be able to

- Demonstrate a familiarity with portfolio theory and equilibrium-based asset pricing models such as the CAPM.

- Evaluate the performance of an investment portfolio and understand the role that skill and luck play in observed investment outcomes.

- Demonstrate a familiarity with the theories and empirical studies of efficiency in major financial markets.

- Understand the role of systematic factors in the behavior of asset returns.

- Identify the behaviour of individual investors and systematic trading biases, as well as the implications on capital market efficiency.

- Communicate an investment strategy and trade according to the strategy.

Credits: 6

Schedule: 25.10.2022 - 08.12.2022

Teacher in charge (valid for whole curriculum period):

Teacher in charge (applies in this implementation): Peter Nyberg

Contact information for the course (applies in this implementation):

CEFR level (valid for whole curriculum period):

Language of instruction and studies (applies in this implementation):

Teaching language: English. Languages of study attainment: English

CONTENT, ASSESSMENT AND WORKLOAD

Content

valid for whole curriculum period:

Portfolio theory, asset pricing models, market efficiency, portfolio management, factor investing, investor behavior, sustainable investing.

Assessment Methods and Criteria

valid for whole curriculum period:

Assignments (25%)

Final Exam (75%)

Workload

valid for whole curriculum period:

Lecture hours 24 h

Exercise hours 12 h

Class preparation 22 h

Exercise preparation 50 h

Exam preparation 50 h

Exam 3 h

DETAILS

Study Material

applies in this implementation

1. Bodie, Z., Kane, A., & Marcus, A. (2014): Investments, 10th edition. McGraw-Hill Education. You can use newer or older editions. In that case, check the chapter numbering which can differ from the one in the 10th edition.

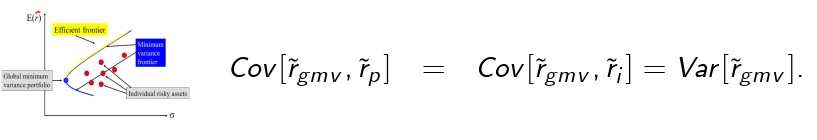

Ch 1 - 3 (preliminaries), 5 (Risk, Return and the Historical Record), 6 (Capital Allocation to Risky Assets), 7 (Optimal Risky Portfolios), 8 (Index Models), 9 (CAPM), 10 (APT and multifactor models), 11 (Efficient Market Hypothesis), 12 (Behavioral Finance), 13 (Empirical evidence on security returns), 24 (Portfolio Performance Evaluation), 27 (Theory of Active Portfolio Management).

2. Luenberger, D. G. (1998): Investment Science, 1st edition. Oxford University Press.

The 2nd edition can also be used. Covers roughly the same topics as BKM but with more mathematical rigorousness.

Ch 6 (Mean-Variance Portfolio Theory), 7 (The Capital Asset Pricing Model), 8 (Models and Data), 9 (General Principles).

3. Lecture and exercise materials.

Substitutes for Courses

valid for whole curriculum period:

Prerequisites

valid for whole curriculum period:

SDG: Sustainable Development Goals

8 Decent Work and Economic Growth

9 Industry, Innovation and Infrastructure

FURTHER INFORMATION

Further Information

valid for whole curriculum period:

Teaching Language : English

Teaching Period : 2022-2023 Autumn II

2023-2024 Autumn IIEnrollment :

This course is offered to BIZ finance bachelor major students only. A maximum of 75 students can be accepted to the course. Fnance BSc major students will be guaranteed a seat on the course. Students re-taking the course (grade already registered) will not be prioritized and can participate only if there are places remaining.

Other BIZ, Aalto, and exchange students students can register for the course FIN-A0104 Fundamentals of Investments.