22E00100 - Financial Statement Analysis, Lecture, 27.2.2024-19.4.2024

This course space end date is set to 19.04.2024 Search Courses: 22E00100

Topic outline

-

Please note that this course is a hybrid implementation. 7 lectures will be completely online, whereas 4 lectures will be held in-person, with the option of joining online. There will be no recordings of the sessions.

After successfully completing the course, you will have the knowledge and skills needed to analyze financial statements in various decision-making situations. In particular, you will be able to analyze financial statements in order to evaluate

- various aspects of the profitability of the firm,

- cash flows vs. accrual earnings,

- credit risk of the firm, and

- the value of the firm.

You will, moreover, be familiar with how valuation models are used when preparing IFRS financial statements, and how accounting for corporate social responsibility becomes more and more important in preparing financial reports. Most of all, you will not be fooled as easily by those kinds of folks:

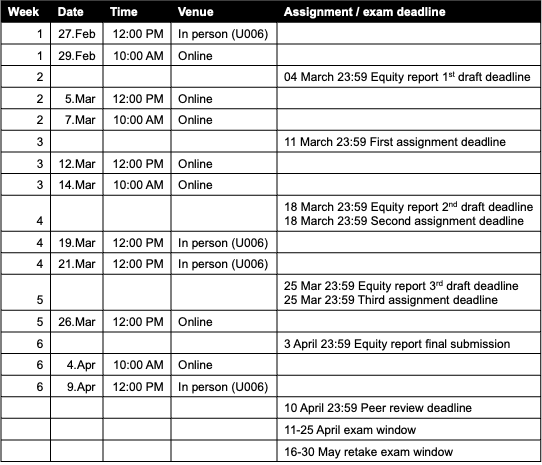

The course content consists of materials published in the MyCourses sections (i.e., modules). The content is partly based on the course book (Petersen, T & Plenborg, C. Financial Statement Analysis: Valuation - Credit Analysis - Executive Compensation. Prentice Hall.). Relevant scientific articles will be provided through MyCourses, too.Here's a snapshot of the course timelines in one place: