25C00100 - Entrepreneurship and Innovation Management, 01.11.2018-22.11.2018

This course space end date is set to 22.11.2018 Search Courses: 25C00100

Glossary

A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | ALL

$ |

|---|

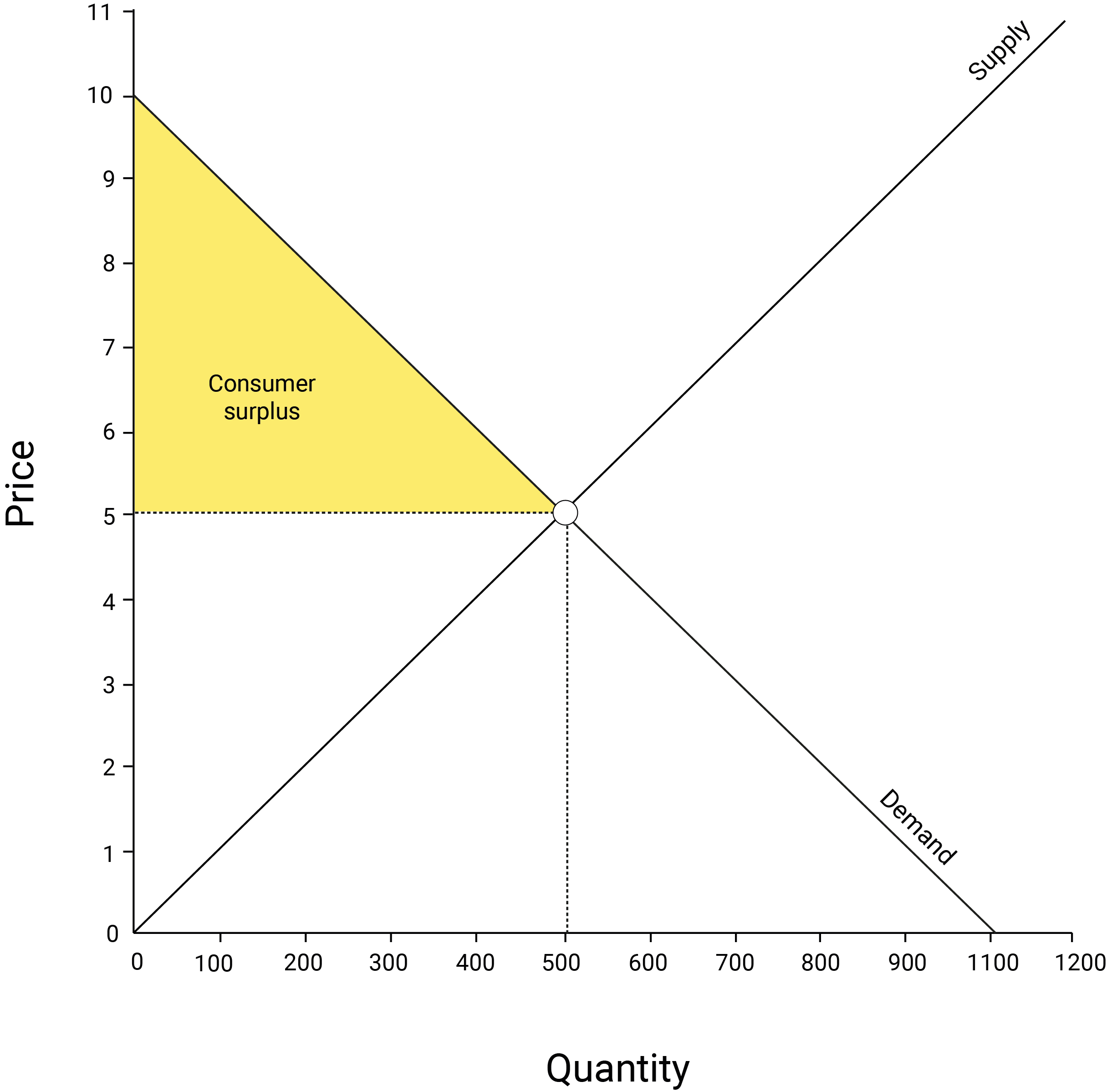

$4 and $3If the customer values a pint of Jane’s beer at $9 and pays $5 for it, they have ‘saved’ $4 that they would have happily spent. This is their consumer surplus. | ||

A |

|---|

alcopopReally? You don't know what alcopops are? OK, here we go ! | ||

B |

|---|

B – CRemember the formula for value creation: value created = benefits perceived by the consumer (B) – the costs incurred by the producer (C). | ||

C |

|---|

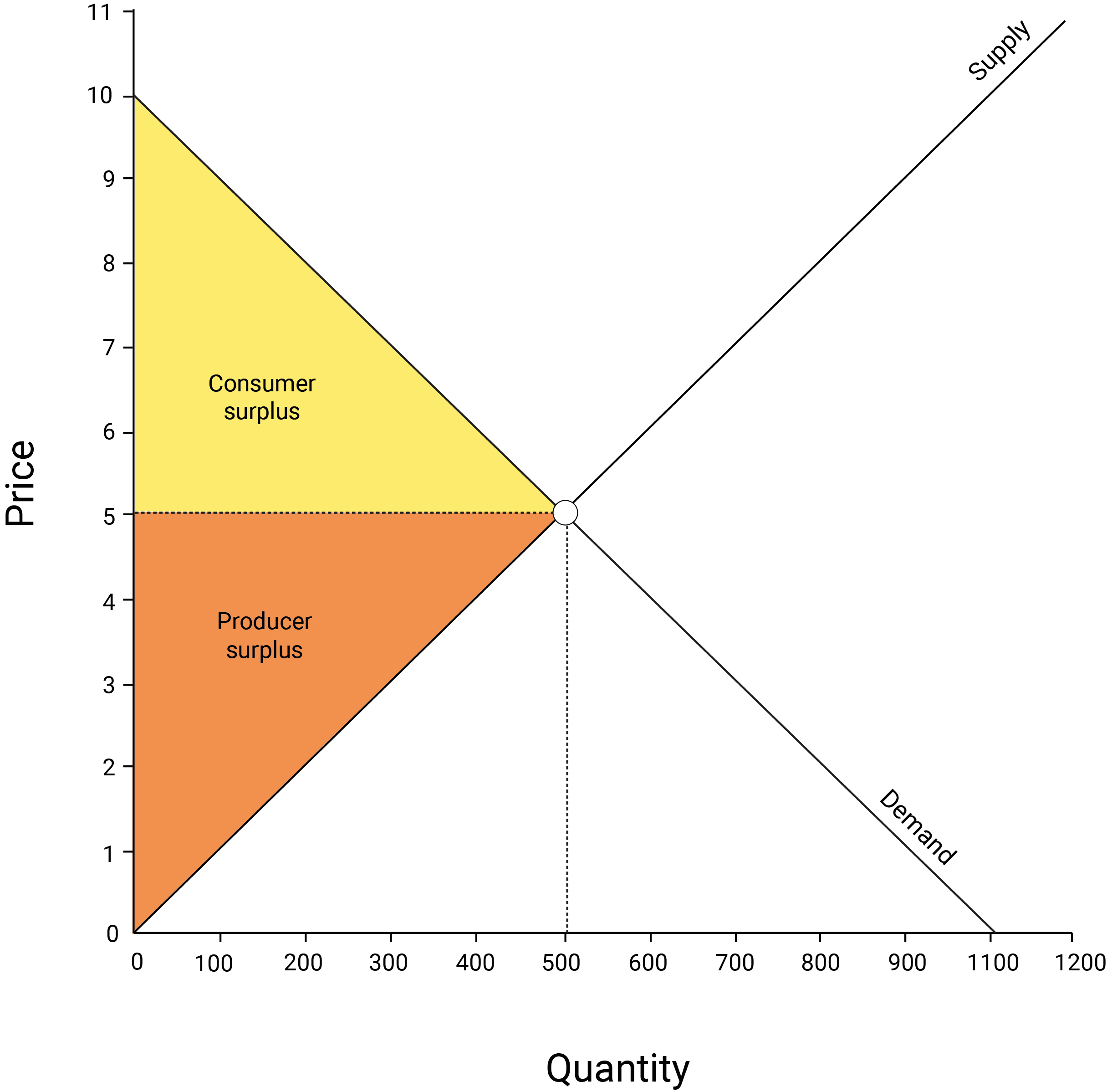

consumer surplusConsumer

surplus is generated when the consumer feels that they get more benefit (B) out

of the product compared to the price (P) that they pay to obtain it. Consumer

surplus occurs when B – P > 0. The market equilibrium price denotes B – P =

0. All points in the demand curve to the left of the equilibrium denote B – P >

0, or consumer surplus.

| ||

contract brewRead more about contract brewing here. | ||

D |

|---|

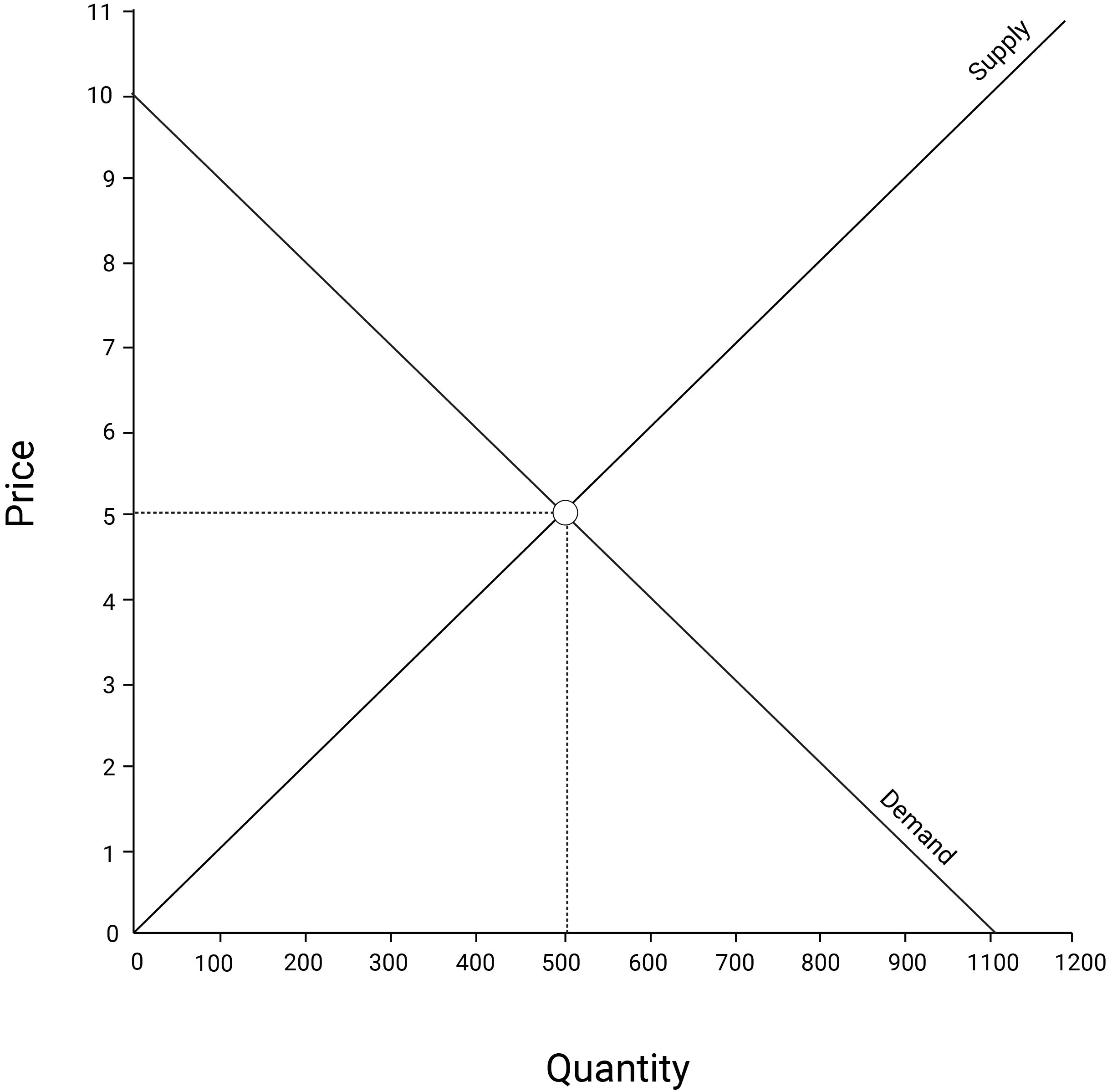

demand curveDemand curve depicts the consumers’ maximum willingness to pay: how many units of the product are consumers willing to buy at a given price. This curve is downward sloping: consumers are generally willing to buy more when the price is low. On a market level, this means that there are more consumers willing to buy the product if the price is low, compared to when the price is high.

| ||

duopoly equilibriumThe following explanation of how the duopoly equilibrium quantities were derived is for those interested – learning all the computations is not necessary to complete the course.

The duopoly price and quantities are based on insights from the so-called Cournot duopoly model. According to this model, the profit-maximising equilibrium outcome for two identical firms – which we assume Jane and Emma to run because they have identical cost structures and sell a homogeneous product – is to produce equal quantities. These two quantities jointly clear the market, meaning that the price is lowered until all that is produced is sold.

The following explains how the equilibrium price and quantity were determined. Emma’s profit (Π) function is as follows:

ΠEmma = Revenue – Total cost = P*QEmma – TCEmma = (100 – QEmma – QJane)QEmma – (800 + 10QEmma) = 100QEmma – QEmma2 – QEmma*QJane – 800 – 10QEmma = 90QEmma – QEmma2 – QEmma*QJane – 800

Emma maximises her profit by (we treat QJane as a constant):

∂ΠEmma/∂QEmma = 90 – 2QEmma – QJane 90 – 2QEmma – QJane = 0 -2QEmma = -90 + QJane QEmma = 45 – 0.5QJane

The final equation is Emma’s reaction function. It gives Emma’s best response to whatever quantity Jane chooses to produce (QJane). Because Jane’s firm is identical to Emma’s, her reaction function is QJane = 45 – 0.5QEmma.

Based on the reaction functions, we can solve the market clearing (equilibrium) quantity as follows:

QEmma = 45 – 0.5(45 – 0.5QEmma) QEmma = 45 – 22.5 – 0.25QEmma 0.75QEmma = 22.5 QEmma = 30

Because Jane’s reaction function is a mirror image of Emma’s, the resulting quantity would be the same. Thus, in a Cournot duopoly equilibrium, Emma and Jane would choose to produce 30 casks of beer each which results in a market price of (P = 100 – 30 – 30) of $40. | ||

E |

|---|

equilibriumYou can read more about market equilibrium here. | ||

F |

|---|

fundamental transformationOliver Williamson refers to this as fundamental transformation: before investing in relationship-specific assets, the buyer can buy from any number of competing sellers (a ‘large numbers’ bargaining situation); after the investment, buying from anyone else than the current seller incurs an additional cost known as the switching cost (a ‘small numbers’ bargaining situation). | ||

I |

|---|

incomplete contractsFactors that prevent complete contracting

| ||

incumbentsIncumbent is a firm that is already operational in a

market. Entrant is a firm that is aspiring to enter the market. | ||

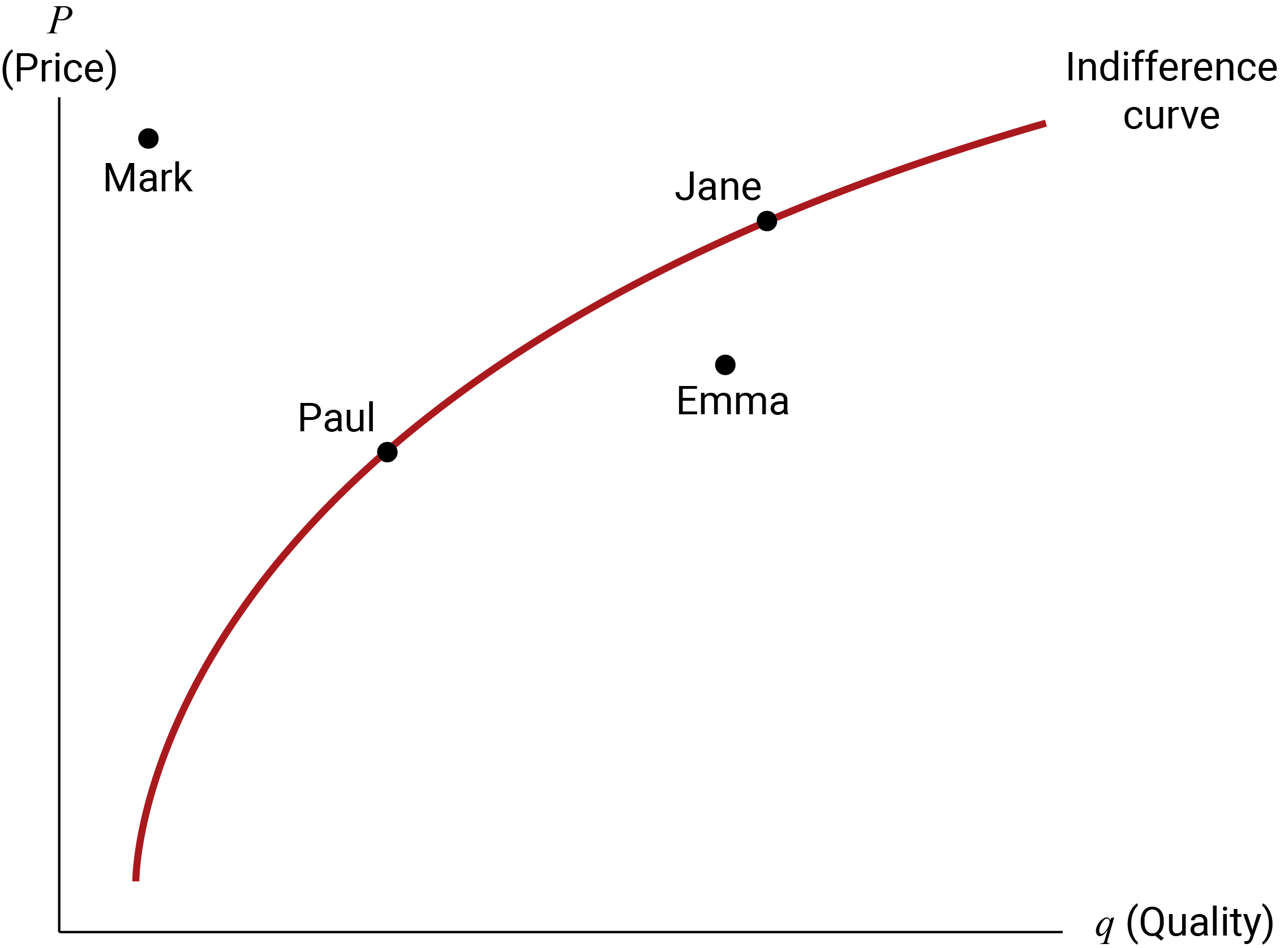

indifference curveIndifference curve denotes different combinations of price and quality that are of equal value to the consumer. So the consumer would be indifferent between choosing a higher quality product for a higher price, or a lower quality product with a correspondingly lower price.

| ||

information asymmetryInformation asymmetry means that Jane knows more about

her business and future intentions than Emma, and vice versa. For example, Jane

knows that she doesn’t have a cost advantage but she counts on Emma not knowing that, and uses this to her

advantage. | ||

M |

|---|

market equilibriumMarket equilibrium price and quantity are found at the intersection of the supply and demand curves.

| ||

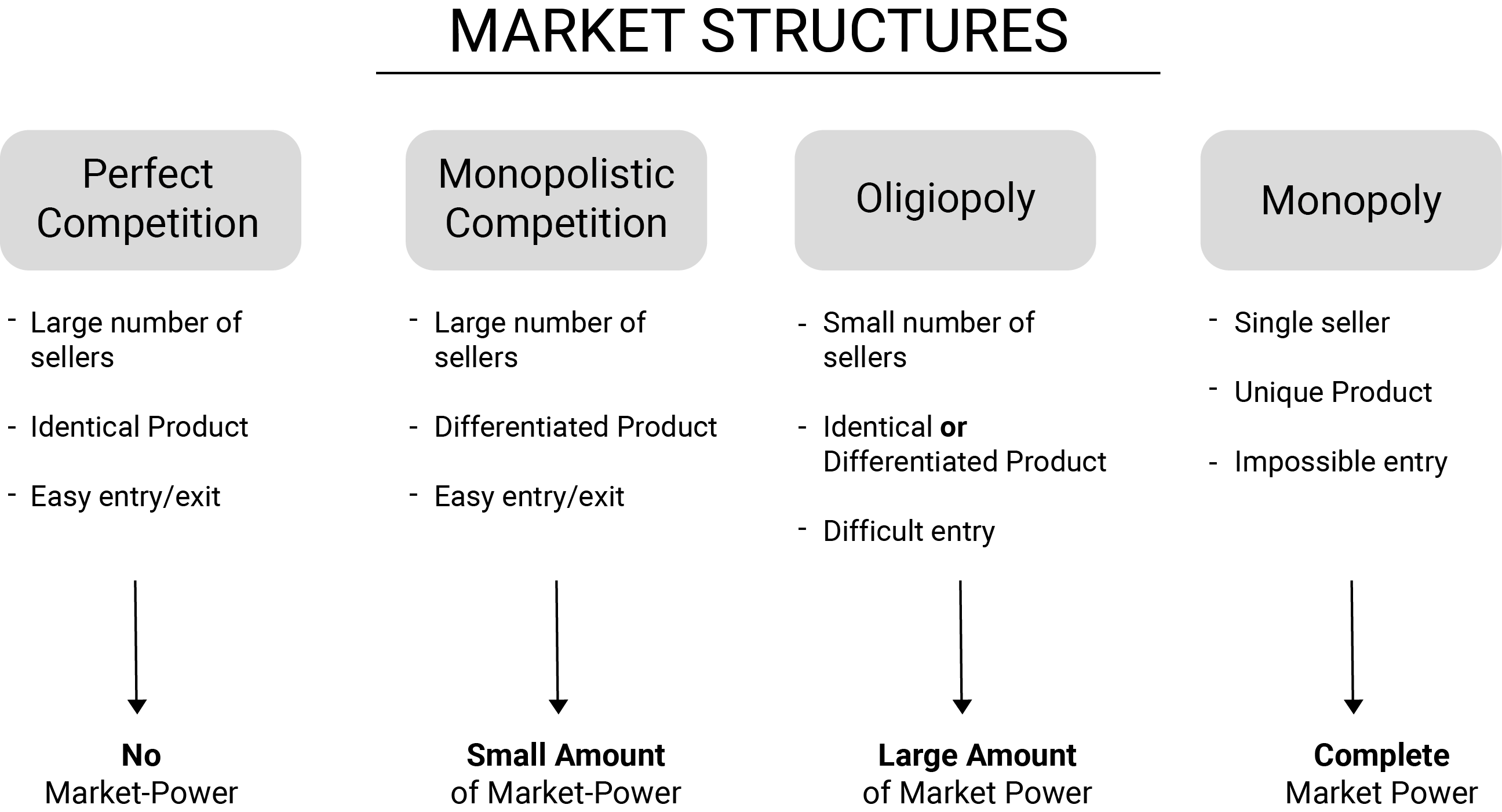

market structures

| ||

maximum willingness to payHow many units of a product are consumers willing to

buy at a given price or what is the maximum dollar amount they are willing to

pay for a unit of the product. | ||

Michael PorterRead more about Michael Porter here | ||

N |

|---|

nash equilibriumRead more about nash equilibrium here. | ||

normal profitProfits that are sufficient to keep the firm in

business but not enough to make the entrepreneur rich. | ||

O |

|---|

opportunity costOpportunity cost refers to the benefit that a person gave up by deciding to take a particular course of action. Because every resource (money, time, physical assets) can be put to alternative uses, every action carries an opportunity cost. This is an important consideration in decision making in business. You can find a more detailed explanation of the concept here: http://www.econlib.org/library/Enc/OpportunityCost.html | ||

P |

|---|

P=MCPrice equals marginal cost, meaning the price just

covers the cost of producing that unit of beer but selling that unit of beer

does not generate any profit. | ||

preventBecause firms can enter and exit costlessly, no single firm can prevent another firm from entering nor would it make any sense to do so because there are numerous competitors anyway in perfectly competitive markets and all of them have to sell at the market price. So there is no incentive to take aggressive action, such as price-cutting, against competitors. | ||

producer surplusProducer

surplus is the flip side of consumer surplus. It is defined as the difference

between the price (P) that the consumer pays for the product, and the cost (C)

to the firm of making that product. If P – C > 0, the firm is making money

and generating producer surplus.

| ||

R |

|---|

recoupWe could assume, for example, that Emma could resell her brewing equipment at exactly the same price that she originally bought them if she exited the business. We could also assume that she would not need to invest in advertising, which is typical sunk cost for a new business. | ||

S |

|---|

short runShort

run refers to a situation when one factor of production is held fixed. For

example, tank capacity in Jane’s brewery is fixed in the short run because

increasing it would require investments in further tanks, which she cannot do

immediately. However, she can make such investments in the long run. | ||

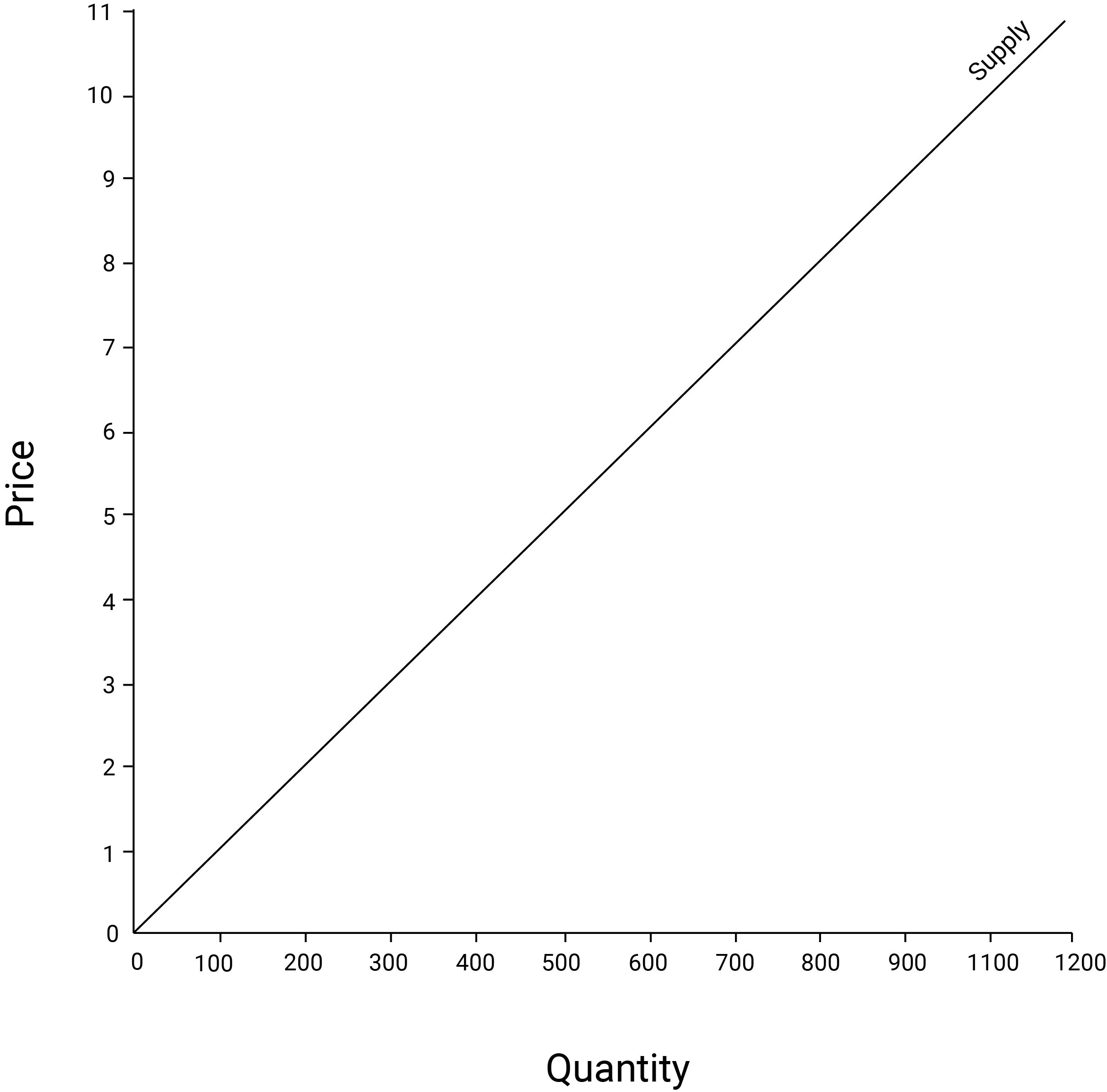

Supply curveSupply curve depicts the quantities that a producer is willing to supply for different prices. This curve is upward sloping: a producer is happy to supply more if the price is high. On a market level, this also means that when the price is high, there are more suppliers willing to operate in the market.

| ||

T |

|---|

transaction costPlease find an explanation about the transaction cost economic theory here. | ||

transaction costsIn a broader sense, transaction costs refer to the costs inherent in economic transactions that are not part of the price paid for a product or service. For example, many people would pay $3 for an ice-cream in a parlour 100 metres from their home, than drive 3 km to another parlour for the exact same ice-cream for $2. Why? Because the transaction cost of petrol, time and effort involved in driving those 3 km there and back are greater than the $1 saving in the price of the ice-cream. | ||

V |

|---|

value chain | ||